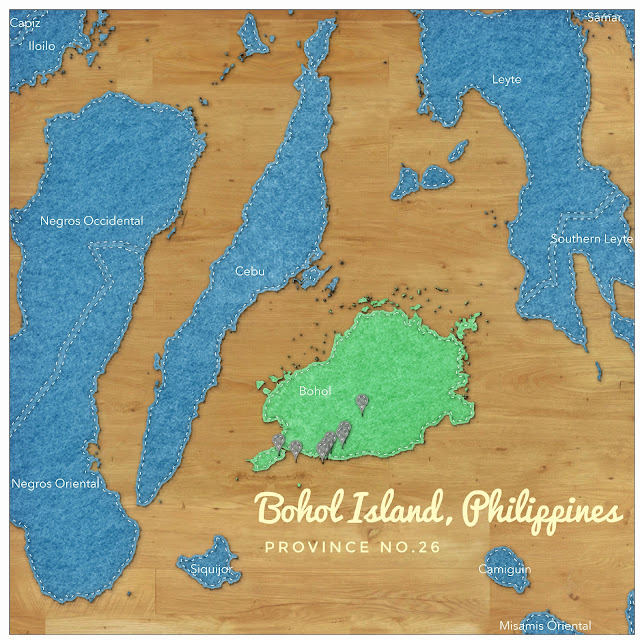

8 Places to Visit in Bohol while Travelling with Kids for 1 day

Bohol is admirable as it is uncomplicated. There are surely a lot more places to discover as we're only exploring it for a day. From Cebu, we took an Oceanjet Ferry to Tagbilaran Port and got ourselves ready for the whole day adventure. Here are 8 places and activities that our family enjoyed during our 1-whole day Bohol exploration trip. BACLAYON CHURCH History is always a first stop and usually on a morning as kids get bored after lunch. There's a tour guide that tells us about the 400 year old history of the church, toured us around the relics and gold and silver statues of Catholic Saints. The painted ceiling inside the church and it's intricately design altar is a stunner. You will be amazed how in an unassuming place like Bohol such a grandeur was hidden beneath. BUTTERFLY FARM at Bohol Habitat Conservation Center What's best to educate the kids than to bring them to places where they can see the animals in the...